cloud_zhou - 2009/1/20 11:21:00

January 19, 2009 | 2147 GMT

Stratfor

The China Banking Regulatory Commission has announced a significant drop in the ratio of non-performing loans held by Chinese banks in 2008. The numbers themselves are somewhat misleading: They reflect both reduced lending from the first half of 2008 as the government attempted to slow the Chinese economy, as well as a massive one-time write-off of bad debt from the Agricultural Bank of China. Despite the apparent drop in NPLs last year, Chinese banks face a significant risk of rising NPL ratios in 2009 — a return of a problem officials tried to sweep under the rug several years ago.

Analysis

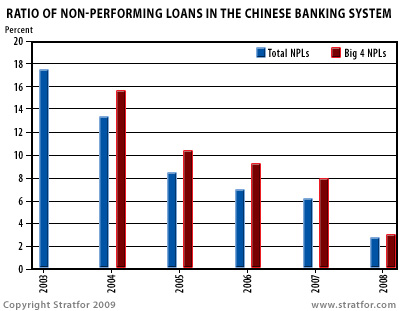

The China Banking Regulatory Commission (CBRC) reported recently that the non-performing loan (NPL) ratio for the country’s foreign and domestic banks fell to 2.45 percent in 2008 from 6.17 percent a year earlier. The NPL ratio at the Big Four state banks (Industrial and Commercial Bank of China, Bank of China, China Construction Bank Corp. and the Agricultural Bank of China) fell from 8.05 percent in 2007 to 2.81 percent in 2008, according to the Jan. 16 report. The overall value of NPLs in the Chinese banking system declined by 700.2 billion yuan (US$102.4 billion) in 2008 to 568.2 billion yuan ($83.1 billion), with 691.4 billion yuan ($101.1 billion) in NPLs cut from the Big Four.

On the surface, the numbers would seem to highlight the strength of the Chinese economy and its banking system at a time when banks around the world are struggling. NPL ratios have long been a key statistic used in assessing Chinese banks, and the government has spent years reforming the Big Four: It cleaned up their balance sheets before public offerings by parceling out their NPLs to asset management corporations. The NPL ratio of the Big Four has fallen from 15.57 percent in 2004 to just 2.81 percent in 2008, according to CBRC figures. The last cleaning of a Big Four balance sheet occurred in November 2008, when some 760 billion yuan (US$111.2 billion) was tran sferred from the Agricultural Bank of China to an AMC. (The bank had reported a total NPL portfolio of 817.97 billion yuan, or US$116.9 billion, at the end of 2007.) That one-time write-off is included in China’s overall NPL numbers — meaning that without it, the Big Four would have seen an increase in NPLs in 2008.

Between late 2007 and mid-2008, the central government was encouraging Chinese banks to slow their lending , as part of an effort to decelerate the overheating Chinese economy. Ideally, this also would have reduced NPLs, since the banks were discouraged from following their standard practice of extending additional loans to inefficient, unprofitable or redundant companies that existed primarily to provide employment. That style of lending was long a mainstay of the Chinese economic model, since employment — and the growth necessary to keep up with new workers — was the driving force behind government policies on lending.

In 2007 and 2008, however, Beijing was growing increasingly concerned that the Chinese economy was expanding too fast. As inflation began to surge, fears about so-called “hot money” inflows rose, and the government attempted to stabilize growth and encourage a more efficient economic model. By mid-2008, however, this model was called into question as soaring commodity prices and ripples from the U.S. mortgage crisis began to take effect. In July, the Politburo called a special meeting on the economy, and from that point a steady reversal of the banking restrictions and deceleration policies began to emerge. In the last months of the year, growth was preferred, if not vital, as weakening consumer markets in the United States and Europe caused a slowdown in China. Interest rates were driven down, loan restructurings were encouraged to extend payment terms, and banks were told to expand lending.

The shift in lending policies and the extensive credit lines needed to implement an enormous stimulus program are likely to raise the NPL levels in 2009 once again, reviving a problem China had hoped to solve — or at least sideline — with the restructurings of the Big Four over the past several years.

The CBRC has already issued somewhat conflicting orders regarding bank loans. It is calling on banks to restructure the terms of loans that cannot or will not be paid (a financially sound policy, but one that also allows banks to play the shell game of simply reclassifying NPLs). It also has called for major banks to increase the amount of reserves set aside to cover potential NPLs, but at the same time is telling smaller banks they can extend loans beyond the limits established by capital adequacy ratios. The CBRC and the Chinese government are struggling with a dichotomic policy — one that requires a significant increase in lending to keep companies afloat, employment up and the economy stimulated, all while trying to avoid a bumper crop of NPLs.

Foreign credit rating agencies are now issuing warnings about the growing risk of NPLs in China in 2009, and foreign banks are selling their stakes in major Chinese banks: The Royal Bank of Scotland and UBS have both dumped Bank of China stakes, and Bank of America has sold a portion of its holdings in China Construction Bank. While these moves are easily explained as necessary fund-raising by foreign banks that are facing their own financial troubles, they also might reflect a loss of confidence in the value of Chinese banks as they cope with both the global economic slowdown and the guidance of a government that views banks more as tools of state policy than as profit-making institutions.

Beijing’s NPL figures are already misleading. They don’t take into account the loans passed off to the various AMCs — which really haven’t disposed of the bad debt — nor do they count reshaped loans, loans that have simply been extended or other accounting tricks used to keep the balance sheets looking clean. Moving the NPLs into different categories doesn’t eliminate the problem, it only sweeps it under the rug. But the more the NPLs pile up, the harder it is to ignore the problem — or avoid facing the consequences.

Between late 2007 and mid-2008, the central government was encouraging Chinese banks to slow their lending , as part of an effort to decelerate the overheating Chinese economy. Ideally, this also would have reduced NPLs, since the banks were discouraged from following their standard practice of extending additional loans to inefficient, unprofitable or redundant companies that existed primarily to provide employment. That style of lending was long a mainstay of the Chinese economic model, since employment — and the growth necessary to keep up with new workers — was the driving force behind government policies on lending.

In 2007 and 2008, however, Beijing was growing increasingly concerned that the Chinese economy was expanding too fast. As inflation began to surge, fears about so-called “hot money” inflows rose, and the government attempted to stabilize growth and encourage a more efficient economic model. By mid-2008, however, this model was called into question as soaring commodity prices and ripples from the U.S. mortgage crisis began to take effect. In July, the Politburo called a special meeting on the economy, and from that point a steady reversal of the banking restrictions and deceleration policies began to emerge. In the last months of the year, growth was preferred, if not vital, as weakening consumer markets in the United States and Europe caused a slowdown in China. Interest rates were driven down, loan restructurings were encouraged to extend payment terms, and banks were told to expand lending.

The shift in lending policies and the extensive credit lines needed to implement an enormous stimulus program are likely to raise the NPL levels in 2009 once again, reviving a problem China had hoped to solve — or at least sideline — with the restructurings of the Big Four over the past several years.

The CBRC has already issued somewhat conflicting orders regarding bank loans. It is calling on banks to restructure the terms of loans that cannot or will not be paid (a financially sound policy, but one that also allows banks to play the shell game of simply reclassifying NPLs). It also has called for major banks to increase the amount of reserves set aside to cover potential NPLs, but at the same time is telling smaller banks they can extend loans beyond the limits established by capital adequacy ratios. The CBRC and the Chinese government are struggling with a dichotomic policy — one that requires a significant increase in lending to keep companies afloat, employment up and the economy stimulated, all while trying to avoid a bumper crop of NPLs.

Foreign credit rating agencies are now issuing warnings about the growing risk of NPLs in China in 2009, and foreign banks are selling their stakes in major Chinese banks: The Royal Bank of Scotland and UBS have both dumped Bank of China stakes, and Bank of America has sold a portion of its holdings in China Construction Bank. While these moves are easily explained as necessary fund-raising by foreign banks that are facing their own financial troubles, they also might reflect a loss of confidence in the value of Chinese banks as they cope with both the global economic slowdown and the guidance of a government that views banks more as tools of state policy than as profit-making institutions.

Beijing’s NPL figures are already misleading. They don’t take into account the loans passed off to the various AMCs — which really haven’t disposed of the bad debt — nor do they count reshaped loans, loans that have simply been extended or other accounting tricks used to keep the balance sheets looking clean. Moving the NPLs into different categories doesn’t eliminate the problem, it only sweeps it under the rug. But the more the NPLs pile up, the harder it is to ignore the problem — or avoid facing the consequences.